|

|

||

|

China |

||

|

Monthly statistics of China's imports of

logs and sawnwood - to 30 11

2025

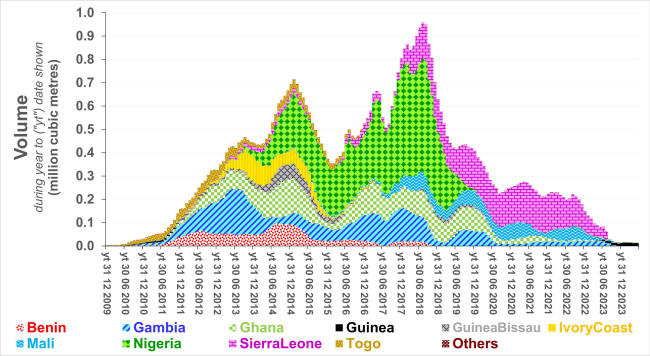

From tropical countries in total and of "rosewood" / hong mu Coniferous logs (other than from tropical countries) Non-coniferous logs (other than from tropical countries) Coniferous sawnwood (other than from tropical countries) Non-coniferous sawnwood (other than from tropical countries) The following chart illustrates how much rosewood China has imported from western Africa as "logs" since 2012. Trade is currently prohibited.  (Source: General Adminsitration of Customs of the People's Republic of China including here) |

||

|

Chart 1 - China's

imports of tropical logs Chart 2- China's

imports of tropical sawn wood Chart 3- China's

imports of logs and sawn wood from Russia

Chart 4- China's

imports of logs (of coniferous species) Chart 5 - China's

imports of sawn wood (of coniferous species) Chart 6 - China's

imports of wood-based pulp

Chart 7- China's

exports of wood-based products Chart 8- China's

imports of wood-based products Chart 9 Chart 10

|

||

|

Charts 6 and 7 indicate that, in terms of RWE volume, China's exports of wood-based products are rising while its imports of timber sector products and paper are declining - dispelling the rhetoric that China desparately needs imports (indeed, so desparately that one must ignore issues of social and environmental sustainability and legality in connection with those supplies; those "needs" will of course include profit and increased market share). The number of listed companies operating in the "forest development" sector in China seems to be reducing, typically after allegations of fraud or financial irregularity.[-][-][-] A number of companies listed on stock exchanges in China, including Hong Kong, appear to hold valuable assets in the sector outside China (compounding the difficulty of verifying them) - one is responding to serious accusations[-][Acre][Rondonia] and is non-compliant with listing requirements concerning submission of its 2012 Annual Report[-]; others appear to dabble and then quit and/or further diversify and/or to make substantial (presumably unintended) losses particularly from changes in asset valuation [p8 & p5][pp25-27][pp6-8]. The lower pair of charts indicates that plans to establish short rotation plantations within China (whether for profit, to reflect government policy or as land grab) to supply China's export-oriented timber and paper sector are likely to prove financially embarrasing to those who promote them. China is the world's leading importer of waste paper. The majority of this is said to be destined for the manufacture of packaging, particularly for goods which are exported. Some virgin wood fibre is used in making the packaging in which goods are exported from China. However, the roundwood equivalent volume of this can not be deduced from trade statistics - and is not included in the quantity of paper exports shown in the lower of the two charts above. Of course, if that virgin fibre is associated with illegality and unsustainability, then the packaging is illegal. Received wisdom has it that thousands of local paper mills using agricultural residues as their fibre furnish have been closed (reflecting a political choice to concentrate manufacture - despite the attendent risks of financial fraud, corruption, inadequate fibre supply and loss of local livelihoods) rather than to require the local mills to install appropriate pollution control devices. In contrast, statistics indicate that such "old" mills not only account for almost one quarter of China's fibre but also that their output is increasing. Government is also obliging the closure of mills which make small quantities of wood-based panels - in response to real concern about poor product quality generally within the industry. China's national statistics of industrial roundwood production are so misleading as to be of little use in the management of China's forest and plantation resouces. They tend either to be confined to the quota allocated to certain state-managed forests (which might differ from what is actually extracted from those forests) or relate to all woody material (including fuel wood) extracted from the country's planted and natural woodland. The lower of the two charts indicates that the volume of pulpwood logged in China is increasingly significant (and might have comprised 20% China's IRW production in 2006). Estimates of China's IRW production appear to be a multiple (more or less constant for each five year inventory period) of the annual quota - the supplement reflecting production from woodland not covered by quota but not necessarily illegal. These figures differ markedly from logging quotas set under China's Five Year Plans. Further, it is widely believed that as much as half of China's IRW production might be illegal. It is also said that China's poplar plantations are being logged at a rate well in excess of new growth - giving cause for concern that China's wood-based panels exports (and, by extension, also China's exports of wooden furniture and flooring) might collapse. The volume of logs extracted for industrial usage from China's timber plantations, in which there is significant considerable (private and World Bank) foreign investment, appears unknown. Given that the quality of most of that timber seems unsuitable other than as raw material for pulp or wood-based panels, that volume is probably less than the sum of the volume of pulpwood consumed (minus imports) and the roundwood equivalent volume of wood-based panels made. China's forestry statistics indicate that national production of industrial roundwood during the first fifty or so years of rule by the Chinese Communist Party increased at an annual average rate exceeding one million cubic metres. This trend - intuitively unsustainable given the (so far) poor success of China's extensive tree farms - changed in 1998. Significant events at this time include the forced withdrawal of the People's Liberation Army from overt participation in commerce and severe flooding (thought to be attributable more to climate change - China is a major contributor - and land management than deforestation). Since 1998, China has imposed logging bans - rather than (socially equitable) sustainable management - in natural forest, mainly in border areas whose already impoverished ethnic minority populations have now in effect lost the right to use their own forest. In some localities, the logging ban is now being relaxed. Recent "reforms" extend state control over forests owned by villages and collectives. Ethnic minorities

have also been adversely affected by policies which offered recent

years' surplus grain harvest in exchange for re-forestation. Those

accepting the offer unwittingly enable the state to take away some

of their rights to use that forest. Half of China's

timber imports are probably illegal

(- some, particularly those from tropical countries, will also be

associated with conflict). Much of this is destined for export after

processing (/laundering). Thus, export markets (primarily

G8 countries) are culpable for much of China's illegal timber

imports. Excluding Canada's exports to the USA and during 2006, China overtook Japan (still the world leader in tropical timber imports) as the world's leading importer of timber. China's principal interest in importing timber is logs - to protect (/supply) its own processing industry, and to compete with established and emerging tropical producer countries in export markets. However, if China utilises more of the timber in those logs than the producer countries do, then this will tend to reduce global timber demand. China is the dominant

market for several major and minor tropical timber exporting countries.

Products made wholly or partially from the timber which China imports

from these countries subsequently enter end-use within China or are

exported. Changes in national or regional procurement policy concerning

timber imports from those tropical countries will generate little

leverage against illegal and unsustainable forest management unless

they expicitly cover indirect imports through thrid countries - notably

China. China would presumably support such changes given its apparent

official position (that trade in illegal timber is an issue primarily

for producer countries and the countries to which China exports products

made from illegal timber) and the benefits to the "Made In China"

brand if China were no longer perceived as the world

hub for trade in illegal timber. Further, those changes would

necessitate adjustments to the supply of timber to enterprises which

manufacture for end-use within China. Although those changes would

minimise the need for China to allocate official responsibility in

order to ensure that illegal timber is not imported into China, controls

would still be needed to protect customers in China and in export

markets against

fraud and other illegality within China. More rapid and

effective leverage might be gained by persuading the handful of clans

from Fujian Province (which some say exert a very powerful influence

over China's timber imports) to procure only from legal and sustainably

managed forests and by working with them to make the transition universal.

(Laws that apply to the conduct of the timber industry in several

producer countries are weaker than what, if internationally enforceable,

should prevail globally.) Of the total weight of wood chips which China declared as imports in 2007, rougly one million tonnes (i.e. less than the pulpwood requirement of even one major pulp mill), Vietnam and Indonesia accounted for roughly 60% and 30% respectively. If the APP group (and others) operating in China were affiliated with producers in Indonesia and/or Vietnam, then they should presumably not be exempted from compliance with China's requirement concerning the conduct of Chinese enterprises active in the sector overseas. A number of factors give China competitive advantages in exporting wood-based products. These include state support for procurement, subsidies to export-oriented manufacturers (e.g. in Export Processing Zones), relative lack of accountability (linked to personalised treatment of public funds and the law), currency manipulation, and employment and environmental standards which might not be acceptable in its competitors' countries. China may also seek export markets in order to absorb the output of its new and probably excessive processing capacity. The upholding of official complaints against manufacturers in China for the alleged dumping of okoumé plywood (in the EU) and wooden bedroom furniture (in the USA) and similar complaints in the Philippines - as well as growing concern about illegal timber (giving clear price advantages) indicate that further investment (and employment) in export-oriented timber processing would be risky. The sectors that

show most potential for increased consumption of timber within China

are those in which, given laissez-faire stewardship by the

government, end-users can exert choice - notably the fitting-out of

residential and commercial buildings (particularly those constructed

with the 2008 Olympic Games

in mind). Such end-users tend to follow fashion, and, therefore, to

be wasteful. Further, projects to clear forest (replacing at least some of this with plantations) have been or are currently subject to controversy, particularly in Yunnan, for example Asia Pulp and Paper and Sino-Forest. Since early 2011, the share price of Sino-Forest, Cathay Forest and China Forestry have collapsed subsequent to allegsations of financial irregularity. . Companies both within China and overseas rightly or wrongly presenting themselves as committed to environmentally sound forestry include Sustainable Forest and China Flooring. The profits and recent losses declared by China Grand Forestry Greeen Resources (which describes its business as ecological forestry but is nevertheless diversifying into coal mining) are largely attributable to changes in its holdings of plantation and forest assets and their valuation. Suggested reading: "Reforestation Programs in Southwest China: Reported Success, Observed Failure, and the Reasons Why" C J Trac, S Harrell, T M Hinckley, and A C Henck (2007) http://faculty.washington.edu/stevehar/JMS%20paper.pdf "China’s Forest Sector: the Reform Era" A Robbins http://www.faculty.washington.edu/stevehar/ARobbins.pdf |

||

|

Copyright

globaltimber.org.uk

|