|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Malaysia

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

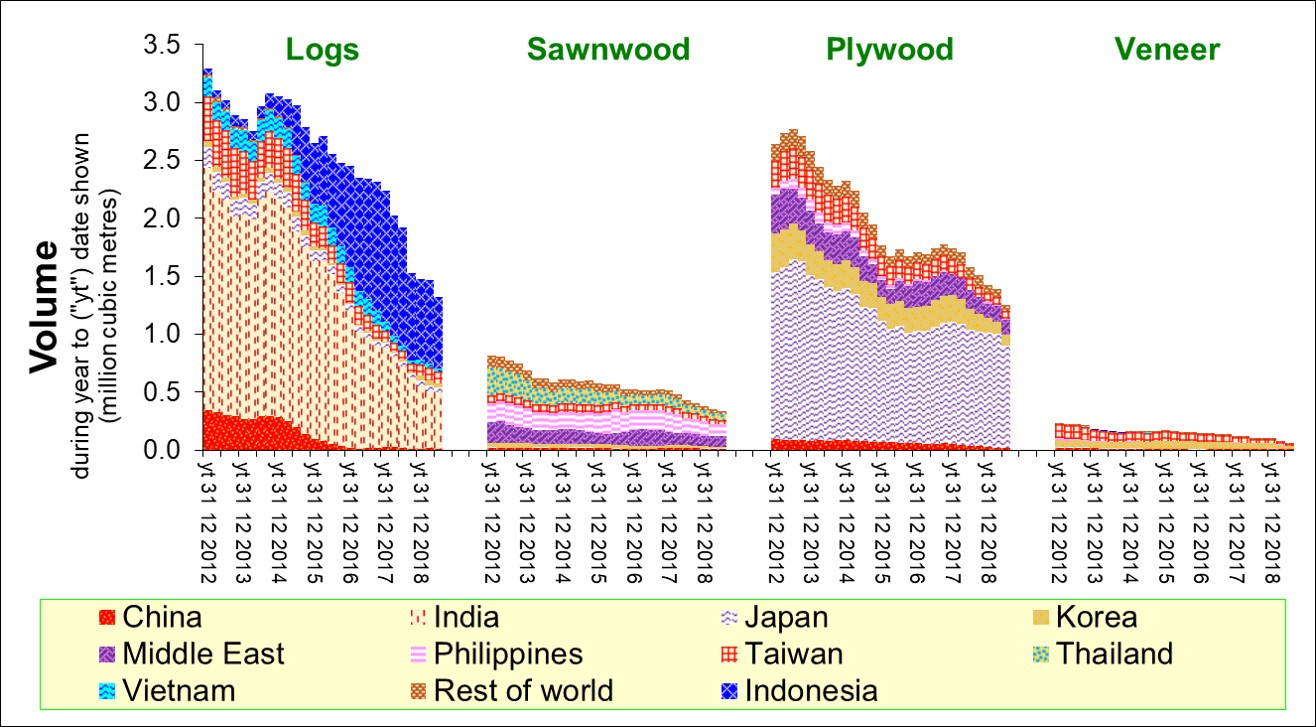

Sarawak's exports of logs, sawnwood, veneer and plywood

For

China's monthly statistics for imports of logs from Malaysia - January

2006 to October 2013 see below

RWE volume

of Malaysia's exports of timber from natural forest (2005, 24mi

m3)

Note: based on MTC statistics, but assumes 80% of wooden furniture exports are of rubberwood[§g p19] and all particleboard and fibreboard derives either from mill waste or rubberwood

Imports of logs from the "Malaysia" declared by China

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Further, forest management and the timber industry in Sarawak bear little resemblance to their counterparts in Sabah and Peninsular Malaysia. This should be taken into account by those seeking to establish legality licensing schemes for Malaysia as a whole. Not only is there a failure to take into account Native Customary Rights in Sarawak, but representatives of several significant stakeholders in this respect are still banned from entry into Sarawak Indeed, if Japan's procurement policy concerning timber supply genuinely seeks to exclude Illegal Timber, then Japan should focus specifically on this and the illegality which characterises much of Sarawak's timber production. During 1995, Sarawak accounted for half the RWE volume of Japan's non-rubberwood timber imports from Malaysia. By 2005, the proportion had risen to almost 70%. This tends to indicate a preference for Illegal Timber in Japan. The decline during 2007 in plywod imports from Sarawak reflects recession in Japan. In contrast (but only in so far as they are not solely from the controversial MTCC-certified concession), the UK's imports of plywood from Sarawak are the only bilateral product flows which might reduce if the EU concludes a Voluntary Partnership Agreement "VPA" with Malaysia under the EU's FLEGT initiative. These are likely to have been negligible during 2006 - customers being unwilling to be associated with Sarawak's timber industry. Commendably, Malaysia is to ask its timber suppliers in other countries to provide certification in respect of the origin of their wood. As the chart above depicting trends in Malaysia's timber imports shows, the EU accounts for less than 5% of those imports. The three charts above illustrating trends in the exports from different parts of Malaysia are provided here particularly in order to help observers estimate the percentage of Illegal Timber in specific importing countries' imports from Malaysia. In Sarawak, • the quality of logging practice tends to be poor (an ITTO report corroborates this description), The ineffective ban which Malaysia imposed from June 2002 on importing Indonesian "round logs" has been supplemented with a ban on "squared logs". Despite that supplementary ban, a politician from Malaysia's dominant party has been caught facilitating the import of illegal timber. During 2002, the political elite at last accepted that their "Asian Values" had caused their nation's forests to approach exhaustion and have greatly reduced the permissible rate of timber extraction in Sarawak and Sabah. However, since then, the RWE volume of Malaysia's timber exports (excluding rubberwood) has risen to levels not achieved since 1996! Although that increase tends to support the view that timber is being laundered through Malaysia, it may be attributable to forest which has been converted (e.g. to plantations) - contributing to climate change. Unfortunately, statistics either of timber volumes extracted from conversion forest or of the area actually converted appear not to be published. It is not clear whether this is deliberate. Malaysia is the world's principal exporter of tropical timber yet its forest area is small relative to that of its major competitors - if one believes FAO forest cover statistics (which, like a number of other FAO forestry statistics, are unsuitable for planning purposes). Although Malaysia expressly intends to ensure that its natural forest area remains at or above a certain area, that statistic can of course be achieved while the commercial, environmental and social value of Malaysia's natural forest - which are of course much more significant parameters - deteriorates. Excess milling capacity (particularly in Sabah and Sarawak) should be closed. Given that most mills are fully depreciated in accounting terms, no compensation should be paid to owners obliged to close the excess capacity of their mills. Plywood accounted for almost half the total RWE volume of timber exported from Malaysia during 2005. Over the last ten years, the increase in Sarawak's plywood exports has largely offset the decline in Sarawak's log exports. The change is attributable almost entirely to a switch (from logs to plywood) in Japan's imports from Sarawak. The surge during 2005 in declared exports of sawn wood from Malaysia to China might reflect a shift in Malaysia's reporting procedures - in response to allegations that substantial volumes of timber were being laundered through Malaysia, via Free Trade Zones. However, given that those exports reverted to their prior trend during 2006 - and that roughly 200,000m3 of sawn wood may be passing through Peninsular Malaysia undeclared. There have been persistent gross mismatches between the volume of logs and sawn wood which Malaysia declares as exports to China and that which China declares as imports from Malaysia. Most of Malaysia's large and increasing exports of (mainly mass-market) wooden furniture is made from rubber wood. The great majority of Malaysia's timber imports from Thailand comprise rubberwood (as sawn wood and panels). In order to meet targets established for 2020 under Malaysia's National Timber Industry Policy, the industry must greatly expand. However, obtaining sufficient raw material is a major concern. Although sourcing missions to Burma might help facilitate supplies to Malaysia, products containing timber from Burma are unlikely to meet legal standards required in a number of the countries to which Malaysia might seek to export. Rather than supply manufacturers in Malaysia, Sabah exports acacia mangium[p22] and some (FSC-certified) tropical timber to countries against which Malaysian furniture exporters compete, notably Vietnam. However, as with exports of other wood chips, Malaysia is considering prohibiting such exports.[p59 p60] It should be difficult to find export markets for wood-based products made at least partly from the very large quantity of plantation-grown trees which Malaysia's National Timber Industry Policy 2009-2020[Table 2.6] (optimistcally even if palm oil looses favour globally and the price of other commodities fall relative to that of timber products) projects will be available. Reasons include the unsustainable origin of the proposed plantations and the record of enterprises which are likely to be involved in establishing those plantations - both of which should be taken into account when importers carry out due diligence of their sources of supply..

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Copyright

globaltimber.org.uk

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||