|

|

||

|

Papua New Guinea |

||

|

|

||

|

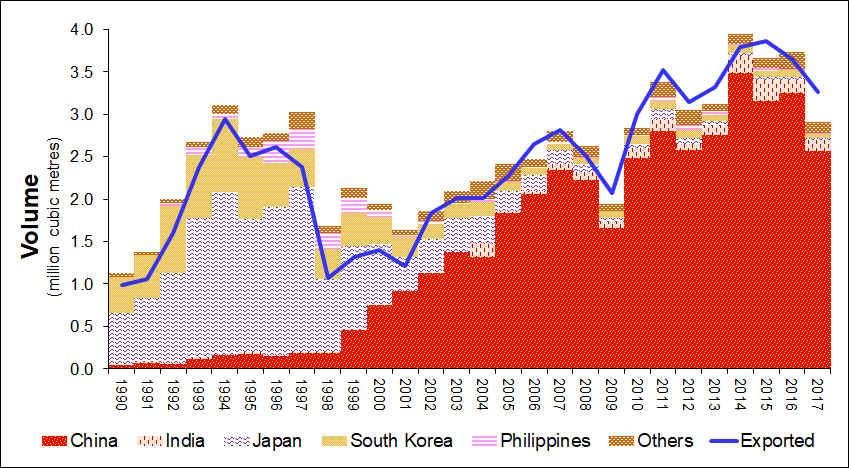

Reported

exports of logs from Papua New Guinea with importing countries' declared

imports from Papua New Guinea

China's imports of logs from Papua New Guinea

- by customs district

China's

imports of logs from Papua New Guinea - by "location of importer"

|

||

|

Papua

New Guinea A legal review of Special Purpose Agricultural and Business Leases (SABLs) followed by a moratorium on the allocation of further SABLs was announced in mid-2011. Two years later, the review has still not been published. SABLs allocate (forest) land to leasholders for up to 99 years with no obligation to hand back that land as forest - elminating the intrisnic character of the land. It seems clear that the SABL's are a form of land grab where customary rights have been ignored[second ¶, p6] , primarily for timber - which is problematic to a government which seeks to increase its revenue from carbon sequestration[second ¶, p10] - and in reality[penultimate ¶, p11] not for palm oil. By 2010, more than 0.5 million cubic metres of logs were being exported (to China) from SABLs.[Table 2] Compounding this reality, Papua New Guinea announced in January 2008 that concessionaires need no longer bother to have and implement plans for the sustainable management of forest concessions (and inventories). Further, the government is to be given 25% of export volumes for itself to sell - no doubt at prices which suit vested interests.[ITTO TTMR 16-31 January 2008] In addition, the government is to promote the export of timber exports - despite their being only one significant buyer (China). Indeed other countries are unlikely to be receptive to such promotion given the flagrant mismanagement of PNG's forest which these new policies imply. There has yet to be a response from donors - who should bear in mind inter alia that increased export values (a) might not correlate closely with export revenues properly received by the PNG Treasury (much more important to PNG's development prospects) and (b) correlates closely with loss of carbon capture. (The prospective market for palm oil as a fuel is contracting very rapidly - outside China.) In addition, the export-oriented logging which accounts for almost all of Papua New Guinea's exports of logs kills 15 to 20 times as much wood as is exported as logs. Those exports in effect kill 200m3/ha or 27%-29% of the forest volume. This is well in excess of norms in other tropical timber exporting countries. Such logging accounts for almost half of the country's very rapid rate of deforestation - 1.4% pa in 2002. It is unclear whether the national Annual Allowable Cut takes into account the associated 15-20 fold forest degradation, but it does seem to assume that exploitation of all forest is equally viable (which it clearly is not in mountainous areas, and that all species and grades of tree are equally profitable. Despite all the evidence of illegality and relevant Memoranda of Understanding, it seems that the government of China will only take action against the import of Illegal Timber if individual products are specifically designated as such by appropriate level of government in the producer country. Given the apparent depth of corruption in the forest sector and related judiciary (including in PNG), it is highly unlikely that producer country governments will do so. Such illegality is likely to persist until there is a sufficient number of high profile guilty verdicts in court (presumably an international one). Exports from China which include species which are commonly exported from Papua New Guinea are likely to comprise Illegal Timber - with the exception of merbau Intsia spp., those species tend currently not to be exported in comparable quantity from any other range states (except the Solomon Islands). It is of course likely that documentation naming the species which comprise(s) those exports will be either misstated or not provided in order minimise the increasing risk that such (illegal) exports loose market access. (Fraud in documentation pertaining to (timber) exports is not a problem unique to China.) Reputable trade associations in importing countries have started to advise their members that, without credible information to the contrary, the balance of probability is that those exports comprise Illegal Timber. China might take steps to minimise its imports of Illegal Timber if importing countries demand credible evidence of legality concerning their imports of wood-based products from China. Papua New Guinea is the largest exporter of tropical timber in Oceania. Rimbunan Hijau, accounting for over half of the country's production, dominates governance of the sector and, by extension, has a major influence on government generally. The largely export-oriented timber industry is conspicuous but generates little revenue for the country - it therefore does little to alleviate poverty and aggravates local animosity. The great majority of the timber exports of both Papua New Guinea and the Solomon Islands comprise logs (99% in the case of those destined initially for China). China has displaced Japan as much the largest importer from Papua New Guinea. Further reading: |

||

|

Copyright

globaltimber.org.uk

|